A new product from 1st February 2023, unavailable on the comparison engine sites, Santander secured loans.

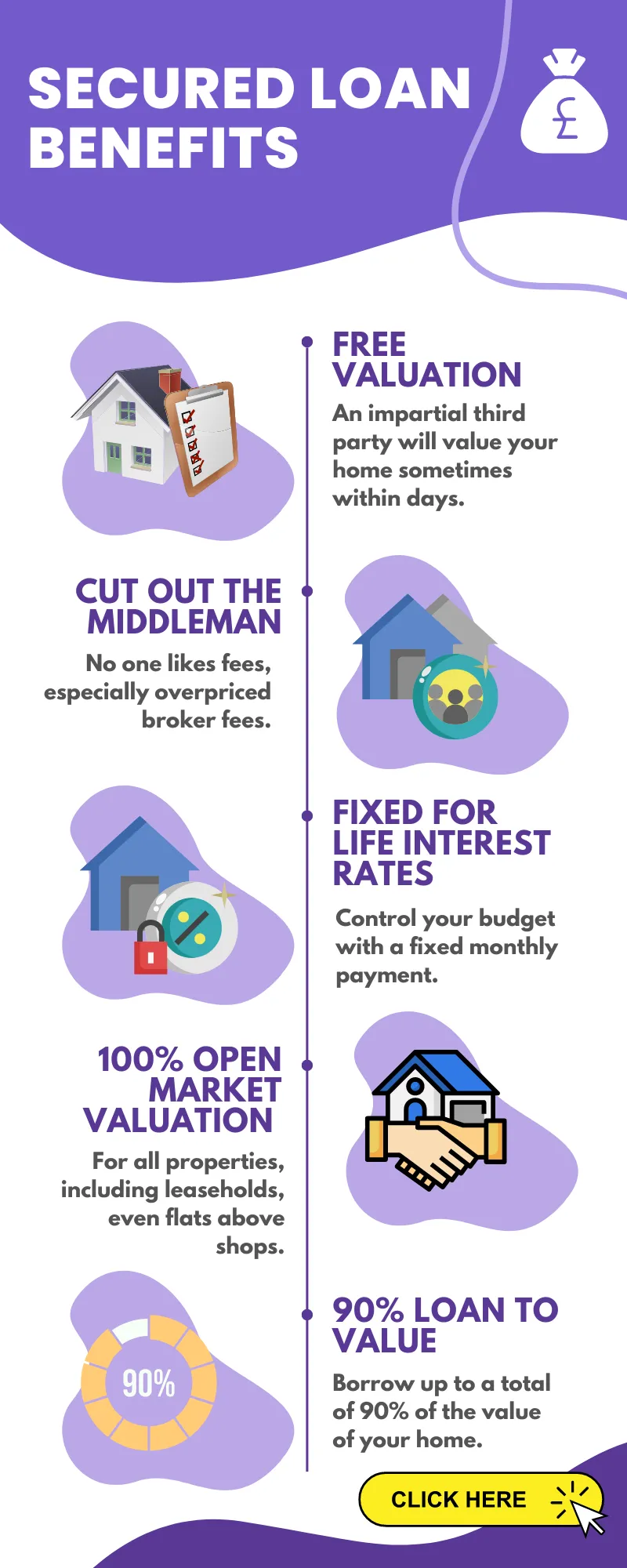

- Loan to value up to 90%

- You don’t need to be an existing Santander customer

- A free no, obligation 3rd party property valuation

- 6.1% fixed for life

- Flats and other leaseholds have full open market valuations applied

- Keep your existing mortgage

- The term can be matched to your existing mortgage for up to 25 years

- No arrangement, product or completion fees

- No early redemption penalties

- Fast agreement in principle based on soft credit search that has no impact on your credit history

Please complete the initial no-obligation enquiry form:

How do Santander Secured Loans work?

You start with an initial consultation to ensure you can afford the repayments on the money you want to borrow and that you don’t have any serious problems like bankruptcy, recent severe credit problems, or mortgage arrears.

Then if that is all OK, a valuer will be sent out to value your home. Once that comes back to Santander Bank, the underwriting team will look at the entire application and look to sign off the loan.

Part of the process will involve your existing mortgage lender being asked if they have any objections to a 2nd legal charge being put on your home. It is very uncommon that they will object.

What is the difference between Santander Secured Loans and Santander Homeowner Loans

In a general sense, homeowner loans and secured loans are similar as they both involve the borrower pledging collateral for the loan in the form of a property.

When are Santander Unsecured Personal Loans the right option?

An unsecured personal loan is a loan that does not require a legal charge on a property. It simply requires a personal guarantee from the borrower or another 3rd party.

These are generally available to people with a strong credit score and for lower amounts, up to around £25,000.

Santander unsecured personal loans are ideal for some people as the funds can be released quickly, and there are no legal processes involving properties.

Benefits Of Santander Secured Loans

Santander Secured loans have several benefits, making them an attractive financing option.

With so much interest in this type of credit product, it’s essential to understand what makes a secured loan such a great choice. Below are just some of the advantages associated with secured loans:

Lower Interest Rates – Secured loans generally offer more competitive rates than other forms of borrowing due to their lower risk profile. This means you could save money over time by taking out a secured loan instead of an unsecured one.

In addition, borrowers can often negotiate better terms and conditions on a secured loan as lenders may be willing to provide additional discounts or perks if they feel comfortable about the security behind the loan.

Flexible Terms – Santander Secured loans typically come with flexible repayment plans that allow borrowers to customise their payments according to budget and personal preferences.

You can usually set up your payment plan around how frequently you get paid, when bills need to be paid, etc., which can help ensure that you remain within your desired financial goals.

Builds Credit History – Making timely payments towards a secured loan is beneficial for building your credit history and improving your existing scores.

As long as all payments are made on time without any missed payments, this will reflect positively on your finances and increase your chances of being approved for future lines of credit.

These are just a few examples of why people opt for secured loans; there are many more benefits, like access to higher amounts, faster application processing times, and even tax deductions depending on the lender’s requirements.

Understanding these advantages can help you make an informed decision on whether or not a secured loan is right for you and your current situation.

What about Santander Debt Consolidation Loans – can they be used to pay back old debts?

Suppose you have a mess of credit cards, loans, store cards, catalogues and other unsecured credit.

In that case, it may help you save money to get a Santander debt consolidation loan, removing the burden of high rate credit and getting the debt down each month.

How To Calculate Loan Amounts

Calculating loan amounts is an important step when considering a Santander secured loan. Knowing your loan amount helps ensure the payment plan fits your budget.

Fortunately, calculating a loan amount doesn’t have to be complicated or time-consuming. Our easy-to-follow guide lets you quickly and accurately determine how much money you’ll need to borrow.

The first thing to consider when calculating loan amounts is the desired purchase price of the financed item.

This will give you an idea of the total cost of borrowing to finance it. Once you know this figure, subtract any down payments or trade-in values before calculating the final loan amount.

Next, calculate interest rates on your desired loan amount by researching current market conditions and comparing different lenders’ offers.

Interest rates can vary significantly between lenders, so shopping around for the best rate available for your specific situation is important.

Finally, factor in fees such as origination charges or closing costs into your calculations to estimate what you’ll pay each month for repayment purposes.

By carefully considering these factors before taking out a Santander secured loan, borrowers can confidently move forward with their financing decisions knowing they are well informed about their financial obligation.

Interest Rates And Terms

Now that you know how to calculate a loan amount, it’s important to understand the interest rates and terms associated with any Santander secured loans.

Interest rates can vary significantly depending on your credit score, collateral offered as security for the loan, and other factors. Loan duration is also essential when considering rate differentials; shorter loan durations often come with higher interest rates than longer-term loans.

When taking out a Santander secured loan, it is essential to read the fine print carefully to know what type of loan interest rate will apply over repayment.

Knowing whether or not there are prepayment penalties before signing a contract can save borrowers from incurring additional fees later on. In addition, make sure that you fully understand all applicable fees, such as origination charges and closing costs.

It may sound basic, but researching a lender’s specific repayment terms before applying for a loan can help ensure you get the best possible deal.

Ask questions about any hidden fees or additional charges to clearly understand your monthly payments once you sign up for a Santander secured loan.

To maximize savings throughout the life cycle of your loan, consider shopping around between lenders and comparing their offers side by side before committing to one particular product.

With this knowledge, you’ll be better equipped to select the right financing option.

Ready to learn more? The section following this one covers repayment options – everything you need to know about creating and managing successful payment plans with Santander secure loans!

Repayment Options

When it comes to loan repayment, Santander secured loans offer various options. An interesting statistic is that nearly 85% of borrowers opt for automated payments, making their loan payment process easier and more efficient.

Whether you need flexible payment options or a long-term repayment plan tailored to your needs, Santander has you covered.

The first option available to customers is an automated payment system. With this method, the borrower’s bank account will be debited each month with the amount due on the loan.

This eliminates any worry about forgetting a payment deadline, as the funds are securely transferred from one account to another automatically and without hassle. Additionally, customers may set up multiple accounts to manage their loan repayments if desired.

Another repayment option offered by Santander is a fixed monthly instalment schedule.

The lender provides customised repayment plans based on individual circumstances, such as income and expenditure levels, so customers can easily stick to their budget while meeting their financial commitments.

Customers also can make additional payments at any time to reduce the overall cost of their loan or even pay off the balance early if desired.

Santander secured loans provide many advantages regarding both convenience and affordability. By offering diverse repayment options, they help ensure that all borrowers can find a suitable solution for managing their finances responsibly and efficiently.

Moving forward, we’ll explore some key benefits of this lending product.

Advantages Of Santander Secured Loans

Santander secured loans offer a variety of benefits that make them an attractive financing solution. For starters, they typically come with low-interest rates, making it easier to manage repayment.

Additionally, Santander offers flexible payment plans and no prepayment penalty – so if you can pay off your loan early, you won’t be penalized for doing so.

Getting approved for a Santander secured loan can also be fast and easy; in many cases, you could have the money deposited into your account within 48 hours of applying.

In addition, Santander also provides helpful customer service representatives who will answer any questions you may have about the process or repayment schedule.

With support like this, getting approved and managing your loan becomes even more straightforward.

These features make Santander secured loans a great option when looking for financial assistance.

From their competitive interest rates to their friendly customer service team, everything about Santander is designed to help you get what you need quickly and easily.

Tips For Borrowers

Before taking out a Santander secured loan, borrowers need to understand the terms of the agreement and plan ahead. Taking on debt is a significant financial decision that should not be taken lightly.

Here are some tips to help you get started:

- Understand Your Loan Agreement – It’s essential that all applicants read through their loan agreement thoroughly before signing. Be sure to ask questions if there’s anything you don’t fully understand before agreeing to any terms or conditions.

- Make Repayment A Priority – Make sure you can comfortably afford your monthly payments when planning for a loan repayment schedule. If possible, budget extra money each month so you can pay off the loan early without penalties from Santander.

- Monitor Your Credit Score – Understanding your credit score is key to securing the best interest rate with Santander Bank. Monitor your credit history regularly and take actionable steps towards improving it, if necessary, by paying down debts or limiting spending habits appropriately. Doing this will also give you more leverage in negotiating better rates with lenders and other creditors in general.

Types Of Collateral Accepted

When obtaining a Santander secured loan, collateral acts as a safety net for the lender. Lenders consider types of collateral before approving an application.

Here are some of the accepted forms of collateral:

- Vehicle Collateral, such as cars and boats

- Real Estate Collateral, including primary homes and holiday properties

- Personal Property Collateral like artworks or antiques

- Savings Accounts Collateral in the form of CDs or bonds

- Jewelry Collateral consisting of gold coins and watches

These items can be used to secure loans from Santander; however, borrowers should remember that if they default on their payments, these items could be taken away by the bank.

As with any type of financial decision, borrowers must carefully evaluate whether taking out a secured loan is right for them.

What documents do I need for a Santander secured loan?

Secured loans in the UK require an asset to act as collateral against the loan. The documents you will need for a secured loan depend on the type of asset used for collateral and other factors such as your income level and credit rating.

Generally speaking, lenders like Santander will require proof of income, address verification, identification like a passport or driver’s license, and bank statements showing recent transactions. Depending on the amount borrowed and the lender’s requirements, additional documentation may be needed.

These documents include proof of assets (for example, if you are using a car or property to secure the loan), details on any existing debts you might have, information regarding your employment status (such as employer name/address/contact details) and tax returns up to three years old.

All these documents must be provided even if it appears they aren’t necessary at first glance-lenders use them to assess an applicant’s risk level before approving a loan application. Hence, all requirements must be met.

It is best practice to ensure all papers presented by lenders during the application process are legitimate in nature, with appropriate stamps from government authorities or independent bodies like solicitors being issued where necessary.

Generally speaking, this helps reduce potential fraud risks associated with securing loans in UK and Europe.

In addition, borrowers should consider additional costs that may be due if their payments fall behind schedule—legal fees incurred from court action taken against them etc.

Also, any administrative charges levied by the financial institutions issuing credit facilities must be accounted for in advance when budgeting future expenses projected over the time frame agreed upon when initially taking out said loan facility, i.e. interest payable going forward.

Finally, applicants should ensure repayment amounts remain within their financial capacity given realistic projections over the remaining term period before signing onto any particular deal.

They don’t find themselves struggling financially down track due to non-compliance-related issues, which could affect credit rating adversely, thereby impacting one’s ability to access cash-based products further down line should the need arise unexpectedly sometime later.

Conclusion

In conclusion, a Santander Secured Loan is an attractive option for those who need extra financial help. It’s quick and easy to apply, with approval times typically taking just 24 hours.

Moreover, due to its competitive interest rates, many customers find that their monthly payments improve after securing a Santander Secured Loan. In 2022 alone, over 100,000 people turned to Santander loans to reduce their debt burden.

If you think this type of loan could work for you, why not contact us today?

Santander Contact Details:

Registered Office:

2 Triton Square

Regent’s Place

London

NW1 3AN

United Kingdom

Registered Number: 2294747

Website: https://www.santander.co.uk/personal/support/contact-us