Are you dealing with monetary troubles and searching for a means to merge your financial situation?

A secured loan could be the perfect solution. Secured loans offer competitive interest rates and flexible repayment terms and can help reduce stress levels associated with multiple debts.

You should consider a secured loan for debt consolidation as it offers an effective way of managing financial obligations while providing peace of mind that your assets are protected in case of default on payments.

With fixed or variable rate options available, there is sure to be one suited to your needs, so take some time now to learn more about what’s involved when taking out this type of loan.

A new product from February 2023, unavailable on the comparison engine sites, Best secured loans for consolidating debt..

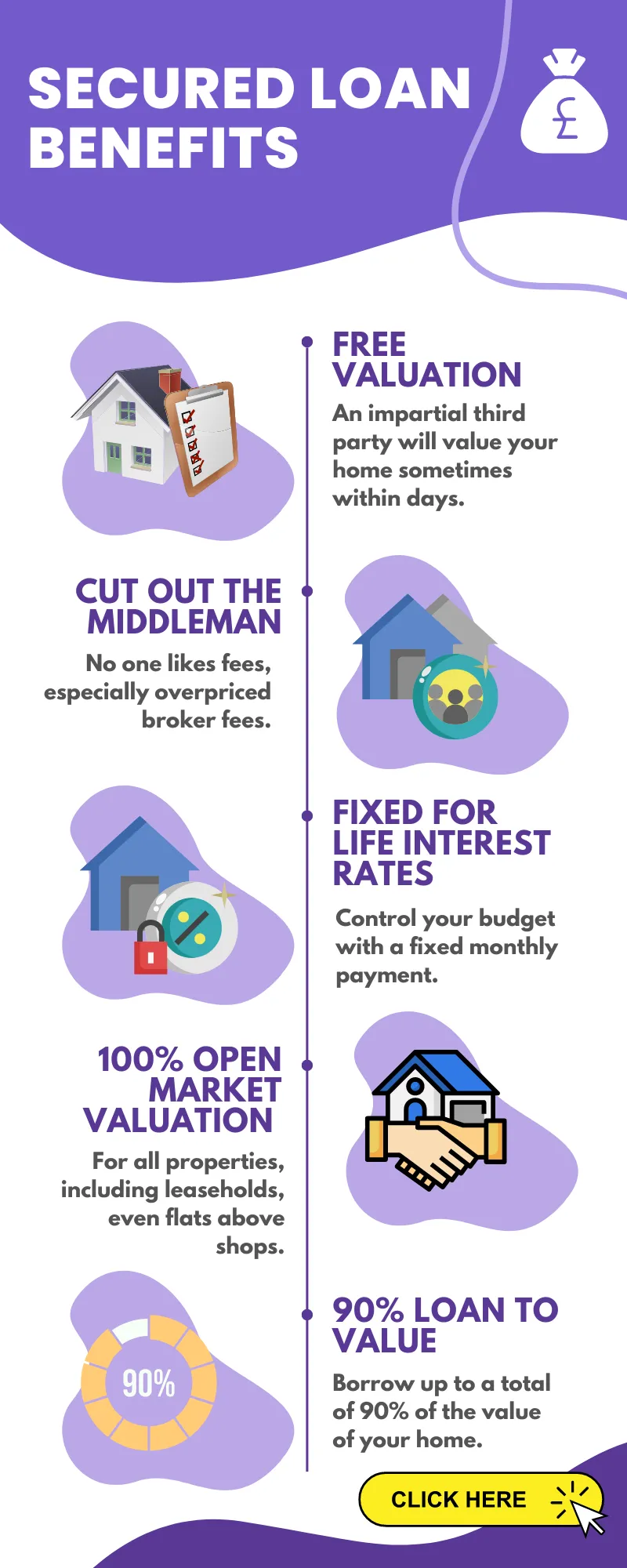

- Loan to value up to 90%

- A free no, obligation 3rd party property valuation

- 6.2% fixed for life

- Flats and other leaseholds have full open market valuations applied

- Keep your current mortgage

- The term can be matched to your existing mortgage for up to 25 years

- No arrangement, product or completion fees to be concerned about

- No early redemption penalties

- Fast agreement in principle based on soft credit search that has no impact on your credit history

Please complete the initial no-obligation enquiry form:

Why Should You Consider a UK Secured Loan for Debt Consolidation?

Debt consolidation with a UK secured loan is an attractive option for UK citizens who own a house, flat or commercial property.

With competitive interest rates and manageable repayments, lenders offer secured loans to those looking to consolidate their debt, even with poor credit.

A secured loan for debt consolidation can offer lower interest rates than unsecured personal loans or credit cards, potentially reducing monthly payments and the total amount owed.

By utilizing a secured loan for debt consolidation, you could pay less on your monthly payments and reduce the amount of money owed by repaying it faster due to lower interest rates.

Additionally, a secured loan can improve credit ratings, as the three major credit agencies report monthly successful payments on time.

To obtain a UK secured loan, one must possess a residential or commercial property that can be used as security for the amount borrowed.

Additionally, evidence showing sufficient income coming in each month is necessary to ensure regular repayments are made on time throughout the agreement term with creditors/lenders offering these services here in this region, targeting individuals living within it.

Therefore, adequate financial standing and credit score are key to this product type’s eligibility.

Although there are many advantages associated with using a secure loan for debt consolidation purposes, there are some potential disadvantages, too, including higher fees charged by some lenders when compared with other forms, such as unsecured personal loans or home equity line credits (HELOCs).

Additionally, depending upon how much equity exists in your home’s value versus what is owed against it, borrowers may not always be eligible for larger amounts required.

Furthermore, obtaining a secured loan can take longer than other forms of borrowing, which could delay access to funds needed quickly under certain circumstances.

Considering a secured loan for debt consolidation can effectively manage your finances and help you get out of debt.

Exploring the various interest rates on UK secured loans can help you secure a beneficial loan for debt consolidation.

What are the Different Interest Rates Available on UK Secured Loans?

When looking to take out a secured loan in the UK, knowing the various interest rates available and how they can affect your repayment options is essential.

To make an informed decision, one must understand the different types of interest rates associated with secured loans – fixed or variable.

Fixed-rate loans offer peace of mind, providing a set amount that will not change over time.

If market conditions shift, you’ll still pay the same monthly amount. The downside is that this could mean missing out on potential savings if rates drop while repaying your loan.

Variable-rate loans can provide more flexibility but may involve more risk due to their fluctuating nature; payments could increase or decrease over time depending on how markets move.

It’s important to understand all aspects of these two options before committing so that you can choose the option which offers better value for money in terms of both cost and repayment flexibility.

When comparing lenders and their interest rates for UK secured loans, there are several key factors to consider such as credit score, personal income level, the total debt owed and length of the loan term.

Each lender will have its own criteria when deciding who qualifies for what kind of deal and at what rate.

Additionally, some lenders may offer discounts or incentives for those with good credit histories or home equity lines from other sources like credit cards or credit unions.

Therefore, it is recommended to research multiple lenders before making a final decision regarding your choice of provider and product offering to get the most competitive interest rate possible.

Before committing to a loan, comparing different lenders and their terms is essential to find the best interest rate available.

Applying for a loan requires meeting certain eligibility criteria and providing specific documents; therefore, let’s explore how to apply for a UK secured loan in more detail.

How to Apply for a UK Secured Loan?

Applying for a UK secured loan is not as daunting as it may seem. With the right information and understanding of eligibility criteria, required documents, and the application process, you can be approved quickly.

When applying for a debt consolidation secured loan, certain eligibility criteria must be met before approval is granted.

Generally speaking, applicants must own property such as a house or flat to use as collateral against the loan amount they wish to borrow.

Additionally, lenders will consider an applicant’s credit score and history when deciding whether or not to approve them for a loan.

Poor credit holders may find it difficult to get a loan from conventional sources, yet they could still be eligible through other avenues such as co-ops or HELOCs.

To apply for any personal loan, including secured loans in the UK, applicants must provide certain documents such as proof of identity and income statements from recent months/years.

These documents should demonstrate financial stability so lenders can feel confident about approving your request for funds.

Additionally, some banks may require additional paperwork depending on the size of your requested loan amount, so it’s best practice to inquire beforehand if possible.

The final step in obtaining approval for a UK secured loan is submitting an application form which includes all relevant details regarding your desired terms and conditions and other pertinent information like repayment schedules.

After this has been completed successfully then, all you need do is wait while your lender reviews everything before giving you their response which usually takes around 48 hours, depending on how busy they are at any given moment during peak periods etc.

Once approved, you can begin repaying according to the agreed-upon terms between yourself and your lender.

This includes considering interest rates and payment frequencies and ensuring that payments are made each month consistently until the completion date arrives. The debt will be fully cleared, leaving both parties satisfied.

Applying for a UK secured loan is an important decision that requires careful consideration.

Thoroughly evaluating your choices and comparing various offers is essential when deciding on a second-charge loan.

Once you’ve taken the time to understand all of your options, here are some helpful tips and advice when applying for a secured loan.

Tips and Advice When Taking Out A UK secured loan

When taking out a UK secured loan, shopping around for the best deal is important. Comparing multiple lenders’ various interest rates and repayment options is key to finding the best deal.

It’s wise to research multiple lenders and compare their offers before committing to one lender.

It is advisable to examine numerous loan providers and evaluate their deals to guarantee that you get the most advantageous rate on your credit and are not paying out superfluous interest or charges.

Repayment options for a UK secured loan vary depending on the lender, but most offer flexible repayment plans with monthly payments over a fixed period of time.

Before committing to a loan, ensure that the monthly repayment amount is within your budget, as failing to do so could incur extra charges or even repossession of your property.

It is also important to understand the terms and conditions associated with a UK secured loan before signing an agreement with any lender.

It is imperative to carefully examine all the paperwork and inquire if anything appears ambiguous prior to consenting to the loan to avoid any future issues when attempting to access funds or make payments.

Additionally, some lenders may require additional collateral, such as another asset or even life insurance coverage which should be considered before signing any agreements.

FAQs concerning Why You Should Consider a Uk Secured Loan for Debt Consolidation

Is it a good idea to consolidate debt UK?

Consolidating debt can be a good idea for individuals living in the UK who own a house, flat or commercial property.

Secured loans can provide flexibility in repayment options, enabling borrowers to adjust the payment plan according to their financial situation.

By combining multiple debts into a single loan with reduced interest rates and more reasonable monthly instalments, it may be possible to decrease total costs and save cash in the long run.

Yet, one should think cautiously before deciding as there could be related risks.

Can you do debt consolidation with a secured loan?

Yes, secured loans can be used for debt consolidation. Secured loans typically offer a fixed rate of interest and loan amount determined by the value of your property, making them an appealing choice for those looking to lower their monthly payments.

The loan term also varies depending on the lender’s criteria, so it’s important to do research before applying to find one that meets your needs.

Why should you get a secured loan?

A secured loan can be a great way to access funds for any purpose, from home improvements and debt consolidation to purchasing an asset.

It offers the security of having your property as collateral against the loan amount, meaning lenders are more likely to approve you for a larger sum than other types of loans.

With fixed or variable interest rates available, you can choose which option best suits your needs.

Plus, it’s fast and easy to check eligibility with our bespoke panel of UK lenders – so there’s no need to worry about being rejected due to poor credit history or lack of income proof.

How does debt consolidation work UK?

Debt consolidation is a way to combine multiple debts into one loan with a single monthly payment. Borrowers can take out a new loan with lower interest rates to pay off their existing debt.

This can help reduce the amount of money paid in interest over time and make managing payments easier by having only one lender and payment due each month.

In the UK, secured loans are typically used for debt consolidation since they offer fixed or variable rates that may be more favourable than other borrowing options.

Conclusion

In conclusion, taking out a secured loan for debt consolidation is an excellent way to manage your finances. For those looking to manage their finances, a secured loan for debt consolidation with both fixed and variable interest rates can provide the ideal solution.

Additionally, it’s fast and simple to apply for one of these loans with a bespoke panel of lenders in the UK. Do your due diligence before deciding on a loan type or lender; take the time to comprehend all terms connected with the loan before signing.

Ultimately, if you’re looking for an effective way to consolidate debts, then considering a UK secured loan could be just what you need.

Take control of your finances and explore the benefits of a UK secured loan for debt consolidation.

You can find the best rate to suit your needs with fast and simple eligibility checks.