For those who have been refused a loan due to poor credit or low income, a UK secured loan may be the solution.

A UK secured loan could be the answer. Secured loans are an option for those who own property such as a house, flat, or commercial space in the UK and can provide fast access to funds with fixed and variable rates available.

Before deciding to take out any loan, it is essential to comprehend the implications and how best to acquire competitive rates for an educated decision.

Read on for all your need-to-know information about uk secured loans, including eligibility criteria, repayment options, risks involved and more.

A new product from 1st February 2023, unavailable on the comparison engine sites, and available from DCL secured loans.

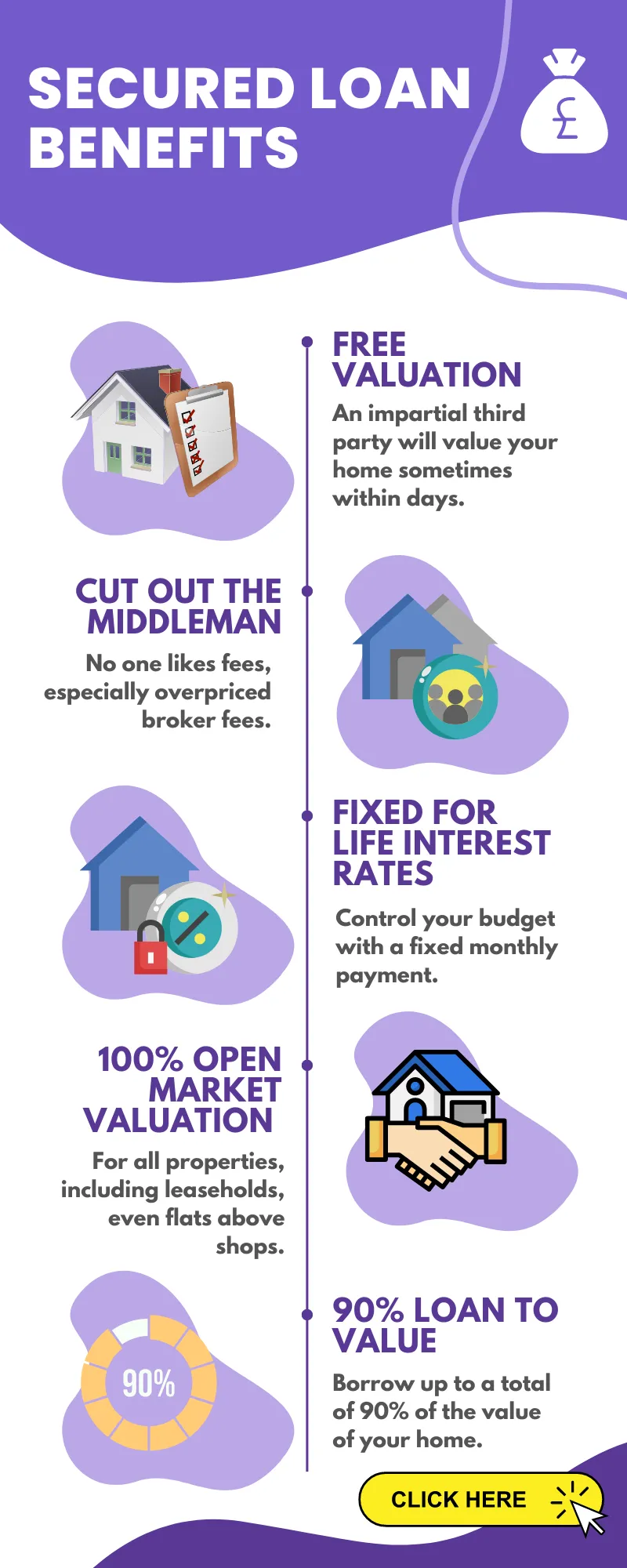

- Loan to value up to 90%

- A free no, obligation 3rd party property valuation

- 6.1% fixed for life

- Flats and other leaseholds have full open market valuations applied

- Keep your existing mortgage

- The term can be matched to your existing mortgage for up to 25 years

- No arrangement, product or completion fees

- No early redemption penalties

- Fast agreement in principle based on soft credit search that has no impact on your credit history

Please complete the initial no-obligation enquiry form:

What is a Secured Loan?

A secured loan is one that requires an asset, such as property or other valuable items, to be used as collateral for repayment of the debt. The lender maintains a claim on the collateral until the borrower has paid back the borrowed amount, plus any interest and fees.

Secured loans can be used for various purposes, including debt consolidation, home improvements, purchasing vehicles or large purchases.

Secured loans generally have lower interest rates than unsecured options, as lenders are exposed to less risk.

Borrowers can potentially save on expenses associated with their loan over both the short and long term thanks to secured loans’ generally lower interest rates.

Additionally, secured loans often offer larger amounts than unsecured options since they are backed by an asset, providing more security to lenders.

When applying for a secured loan, different forms of property may be utilized as security based on the lender’s standards and preferences.

These include residential properties such as houses and flats; commercial properties like offices and shops; land; cars; boats; jewellery; art collections; savings accounts or investments portfolios, etc.

Ultimately, it depends on what each individual lender will accept as acceptable forms of collateral when assessing applications from potential borrowers, so it pays to shop around before committing to any particular deal.

Secured loans offer many advantages and can be used with various types of collateral, making them an attractive choice for borrowers. Before applying for a secured loan, it is essential to check that one meets all the necessary requirements. Now let’s take a look at who can apply for secured loans.

Who Can Apply for a Secured Loan?

Secured loans are an excellent option for homeowners in the UK who need to borrow money. Before taking out a secured loan, it’s essential to understand the eligibility criteria and other factors that could affect your ability to qualify.

The first step is understanding the eligibility criteria for secured loans. To qualify for a secured loan in the UK, applicants must be 18 or older and own property with sufficient income to cover repayments.

You also need sufficient income from employment or self-employment that can cover any repayments on the loan. Most lenders necessitate evidence of identity, e.g., passport or driver’s license, to approve a request.

Borrowers should typically possess a good credit rating, generally in the region of 650 or above, to be eligible for secured financing.

When assessing your request, lenders may also evaluate other criteria, such as the DTI (debt-to-income ratio); this metric computes how much of one’s income goes towards existing debts each month versus what is left over after costs are settled every month.

Lenders may deny your request if the DTI is too large, suggesting you wouldn’t be able to handle repayment on a fresh loan.

Secured loans are a great option for homeowners in the UK, but it is important to understand eligibility criteria and credit score requirements before applying. Comparing rates, fees and charges can help you find the best deal on your secured loan.

How to Find the Best UK Secured Loan Rates?

Finding the best UK secured loan rates requires comparison shopping and understanding of fixed vs variable interest rates. It is important to compare fees and charges when considering a secured loan.

When looking for the best rate, it’s important to shop around. Compare multiple loan offers to find the best rate and terms, taking into account any fees or charges associated with each.

When assessing loans, it is critical to look at more than just the interest rate; extra costs or fees linked with obtaining a loan such as an application fee or penalty for early repayment must be taken into account.

Interest rates on secured loans can either be fixed or variable. Fixed interest rates remain unchanged throughout the term of the loan while variable interest rates can change over time in line with market conditions.

A fixed-rate loan offers a more predictable payment amount, but typically at an increased cost compared to a variable-rate one that could be advantageous if market conditions become better during the duration of borrowing.

By taking the time to compare rates and terms, you can find a UK secured loan that is tailored to your specific needs. Before committing to a UK secured loan, it is essential to consider any potential risks associated with the agreement.

What are the Risks of Taking Out a UK Secured Loan?

Taking out a UK secured loan is an important financial decision that requires careful consideration of the associated risks. A secured loan is when you use your property as collateral to borrow money, and if payments are missed or default occurs, there can be serious consequences.

The most significant risk of taking out a UK secured loan is the potential negative impact on your credit score. Defaulting on a loan payment can lead to late fees, higher interest rates and even foreclosure proceedings against your property.

This could significantly reduce your credit score, making it difficult for you to access other forms of financing in the future such as mortgages or car loans. It’s also important to note that missed payments will remain on your credit report for up to six years after they occurred, so it’s essential to make sure you keep up with repayments each month.

Another risk associated with taking out a UK secured loan is the possibility of foreclosure if payments are not made or default occurs. If payments are not made or default occurs, lenders may take the collateral property to recoup their losses.

This process can be costly and time consuming for both parties involved and should be avoided at all costs by ensuring regular repayment schedules are kept up with each month without fail.

It is essential to be aware of the potential dangers associated with obtaining a UK secured loan prior to settling on any decisions, as it can have far-reaching consequences for one’s financial situation. Moving on, we will discuss how you can repay your UK secured loan and what options are available to help reduce interest costs.

How to Repay Your UK Secured Loan?

Repaying a UK secured loan is an important part of the borrowing process. It is critical to comprehend the repayment plans and conditions prior to obtaining a loan, as this will help you make sound decisions regarding how much can be borrowed.

Repaying a UK secured loan can be done by making regular payments over time, paying off the entire balance at once, or taking advantage of opportunities to reduce interest costs with additional payments.

Additionally, there are often opportunities for borrowers to reduce their interest costs by making additional payments on their loans.

Understanding Repayment Options and Terms:

When it comes to repaying your UK secured loan, there are two main types of repayment plans available – fixed rate or variable rate. Fixed-rate loans have a set interest rate that remains constant throughout the loan period, while variable-rate ones can vary depending on market conditions.

In addition, some lenders may offer different payment structures such as balloon payments or biweekly payments which require larger lump sum payments at certain points during the life of the loan in order to reduce overall costs.

When considering how to repay your UK secured loan, it is important to understand the repayment options and terms available. Exploring other options, like unsecured personal loans or HELOCs (home equity lines of credit), may be worth considering prior to settling on a repayment plan.

What are the Alternatives to Taking Out a UK Secured Loan?

When considering alternatives to taking out a UK secured loan, there are two main options: unsecured personal loans and home equity lines of credit (HELOCs).

Unsecured personal loans do not require any collateral. Lenders will assess the borrower’s creditworthiness and repayment capability, instead of demanding collateral, when evaluating unsecured personal loans.

These types of loans usually have higher interest rates than secured loans, as they carry more risk for the lender. Home equity lines of credit (HELOCs) are another alternative option.

A HELOC is a type of revolving line of credit that uses your home as collateral. This means you can borrow against your home’s value up to a certain amount and pay it back over time with interest. However, if you default on payments or fail to meet other obligations associated with the loan, your lender could foreclose on your property in order to recoup their losses.

Consequently, it is imperative to think about the possible risks involved in either taking out an unsecured personal loan or a HELOC before determining which choice is most beneficial for you financially.

Before taking out a UK secured loan, it is important to consider the alternatives available and determine which option best suits your financial needs.

Seeking the counsel of a competent financial expert may be advantageous in guaranteeing that you make the right decision for your situation when assessing these choices. Next we will discuss what should be considered before taking out a UK secured loan.

What Should You Consider Before Taking Out a UK Secured Loan?

Before taking out a UK secured loan, it is important to assess your financial situation and needs. Evaluate your current fiscal state and outgoings, in addition to any other existing liabilities.

Before taking out a UK secured loan, it is important to assess your current financial situation and needs, determine if the loan will be beneficial in achieving long-term goals or make matters worse, and ensure that funds are used for something worthwhile.

It’s important to make sure that the money from the loan will be used for something worthwhile and not just for impulse purchases or luxury items.

It is also recommended that borrowers seek professional advice from an experienced financial advisor before taking out a UK secured loan. An experienced advisor can provide valuable insight into what type of loan would best suit your individual circumstances, including repayment terms and interest rates available on different loans.

An experienced financial advisor can help ascertain the amount you’re able to borrow based on your income and any existing debt, making sure payments remain manageable throughout the loan’s duration.

FAQs in Relation to Uk Secured Loans

How do secured loans work in the UK?

In the UK, secured loans are those which involve a borrower providing collateral to their lender in exchange for more competitive interest rates than unsecured loan products.

The lender will use this security to protect their investment and offer more competitive rates than unsecured loans. When taking out a secured loan, you agree to give the lender access to your asset if you fail to keep up with repayments on time. This means they can repossess it and sell it off if needed, which helps them reduce risk when lending money.

It’s important for borrowers to be aware of this before taking out a secured loan so they understand the risks involved in borrowing money using their assets as collateral.

What is secured debt UK?

Secured debt UK is a form of loan where the borrower provides an asset, such as a house or car, as collateral. This form of loan offers more attractive terms than unsecured loans, such as lower interest rates and the ability to borrow larger amounts over longer repayment periods with fixed monthly payments.

It also allows borrowers to borrow larger amounts over longer repayment periods with fixed monthly payments. Should the borrower fail to meet their repayment obligations, lenders may repossess and liquidate the collateral in order to recoup any losses.

1. Home Equity Loan:

A home equity loan is a secured loan that uses the borrower’s home as collateral. Using the equity of their home as collateral, borrowers can access funds based on how much value they have in it.

2. Mortgage Refinancing:

This type of secured loan allows borrowers to refinance an existing mortgage with a new one at a lower interest rate or different terms, allowing them to save money over time by reducing monthly payments or shortening repayment periods.

3. Personal Loan Secured By Property:

This type of secured loan requires the borrower to use some form of real estate as collateral for the funds borrowed, such as land, buildings or vehicles owned by them personally (not through business). The lender will then hold onto this asset until all outstanding debt has been repaid in full.

4. Car Title Loans:

These are loans where you put up your car title as security for cash advance from lenders who specialize in providing these types of loans quickly and easily without any credit checks required beforehand – making it ideal for those with bad credit scores who need quick access to emergency funds when needed most.

Secured biz loans necessitate the borrower to present some form of guarantee, like real estate or other commercial assets, in order to acquire a loan from a lender. This kind of loan necessitates the borrower to furnish some form of guarantee, such as real estate or other corporate possessions, in order to obtain financing from a lender.

Is it easy to get a secured loan UK?

Yes, it is feasible to acquire a collateralized loan in the UK. Secured loan products are accessible from various providers, with both fixed and variable rates obtainable. A simple eligibility check can be done online with many lenders offering bespoke panels for customers in the UK.

Depending on your individual circumstances, you may be able to access competitive rates for secured loans that could provide an affordable way to finance larger purchases or consolidate existing debts.

What about bad credit secured loans?

Getting a secured loan in the UK with bad credit isn’t always easy, however, it is possible if you understand how lenders assess your eligibility.

Generally speaking, lenders will consider several factors when assessing your suitability for the loan including your financial history and credit record.

For borrowers with bad credit, collateral such as property or other assets will be used to secure a loan.

This means that the lender has some form of security against defaulting on payment of their money back which can help improve the chances of being granted a secured loan.

As such, in order to increase your chance of getting a secured loan with bad credit in the UK, it’s important to provide enough security to guarantee repayment of that debt.

It also goes without saying that establishing an excellent repayment plan and demonstrating sound financial discipline will significantly improve an applicant’s chances of securing finance from any lender – not only those lenders who specialize in financing borrowers with bad or poor credit histories.

It’s also worth noting that many financial institutions have recently reduced their lending criteria due to Covid-19 legislation changes so now might be a good time to apply for this type of financing solution even if you have had issues related to your credit score in the past.

However, ensure you shop around and compare interest rates as different companies may charge vastly different rates so finding one offering favourable terms could make all the difference when applying for this type of financing option.

Conclusion

UK secured loans can be a viable option for those requiring money. Still, it is essential to bear in mind that the borrower must possess an asset of value and may have to accept interest rates greater than with other borrowing methods.

It is also important to consider all available alternatives before taking out any type of loan, including a UK secured loan.

Ultimately, when used responsibly and carefully considered in light of your individual circumstances, UK secured loans could provide you with much-needed funds at competitive terms.

Take advantage of our competitive rates and quick loan eligibility check to find the right secured loan for you.

With a bespoke panel of UK lenders, we make it easy to get the best deal on your financial needs.