Are you considering taking out a secured loan to help with your finances? Tesco Bank offers competitively priced loans that can provide additional funding for those in need.

With fixed and variable rates, fast and straightforward eligibility checks, and access to a bespoke panel of UK lenders – Tesco secured loans are worth exploring as an option.

Read on to learn more about the requirements, interest rates & fees associated with this type of borrowing.

A new product from 1st February 2023, unavailable on the comparison engine sites, Tesco secured loans.

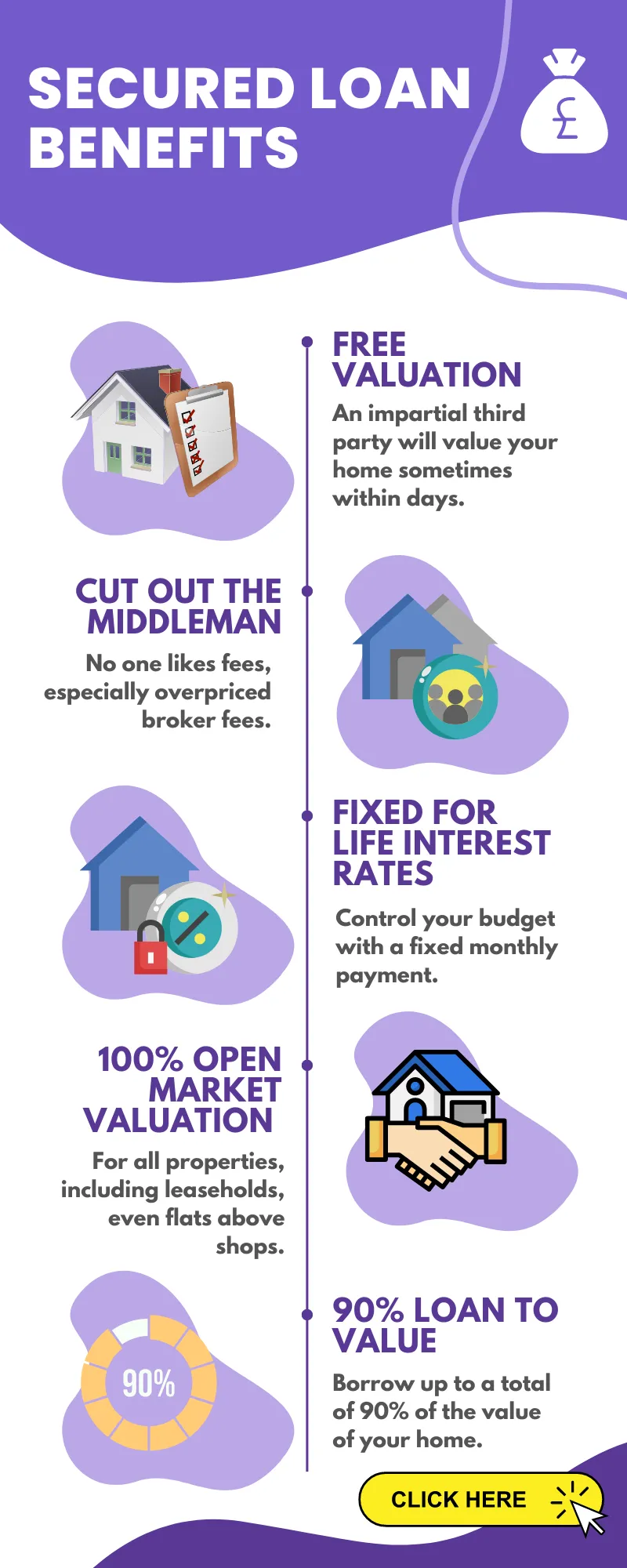

- Loan to value up to 90%

- You don’t need to be an existing Tesco Bank customer

- A free no, obligation 3rd party property valuation

- 6.1% fixed for life

- Flats and other leaseholds have full open market valuations applied

- Keep your existing mortgage

- The term can be matched to your existing mortgage for up to 25 years

- No arrangement, product or completion fees

- No early redemption penalties

- Fast agreement in principle based on soft credit search that has no impact on your credit history

Please complete the initial no-obligation enquiry form:

What is a Tesco Secured Loan?

A Tesco secured loan is a type of loan where the borrower pledges an asset, such as their home or car, as collateral for the loan.

If the borrower does not repay the loan, the lender can repossess the asset pledged as collateral and recoup their losses. Since they are backed by collateral, secured loans tend to have lower interest rates than unsecured ones.

What are the Benefits of a Tesco Secured Loan?

Tesco secured loans have several benefits compared to other types of financing options.

They typically come with lower interest rates and longer repayment terms than unsecured personal loans, making them more affordable for borrowers who need more significant sums of money over an extended period.

Lenders are typically more lenient regarding credit scores for secured loans from Tesco Bank, allowing those with less-than-perfect ratings the opportunity to access financing.

How Does a Tesco Secured Loan Work?

Once Tesco Bank has accepted your security, you can set up your repayment plan.

This includes fixed monthly payments over an agreed-upon period until full repayment, plus any applicable fees and interest charges associated with taking out this type of finance product.

A Tesco Secured Loan is an excellent option for homeowners needing money, offering competitive rates and flexible repayment terms.

Eligibility requirements will vary depending on the lender, so it’s important to understand what you’ll need to qualify before applying.

Eligibility Requirements for a Tesco Secured Loan

When it comes to taking out a Tesco secured loan, there are specific eligibility requirements that must be met.

These include minimum credit score, income and employment, and property requirements.

Minimum Credit Score Requirements:

To qualify for a Tesco secured loan, applicants must have at least a fair credit score of 580 or higher. Applicants with a credit score of 580 or higher can be confident that they can meet their loan repayment obligations.

Higher credit scores may be required by lenders, depending on the loan amount and other factors such as income level or debt-to-income ratio.

Income and Employment Requirements:

Applicants should also meet the lender’s minimum income requirement, which varies by lender but is usually around £20,000 per year after tax deductions.

They should also provide proof of stable employment over the past two years with no more than one gap in employment during this period of time.

Finally, applicants need to own a house, flat or commercial property to secure the loan against it; this provides security for the lender if borrowers fail to repay their loans according to schedule.

Additionally, any existing mortgages attached to the property must be paid off before applying for a Tesco secured loan, as these take priority over any other debts when repaying them from sale proceeds should defaults on payments occur.

Before taking out a Tesco secured loan, it is important to understand the eligibility requirements. Before committing to a Tesco secured loan, looking into the applicable interest rates and fees is essential.

Interest Rates and Fees for a Tesco Secured Loan

At Tesco, two types of secured loans are offered – fixed rate and variable rate – with the former having a constant interest rate throughout its tenure while the latter may change due to market conditions.

Fixed-rate loans offer a set interest rate over the entire term of the loan, while variable rates can fluctuate based on changes in the market. It’s essential to understand both options before making your decision.

Fixed Rate vs Variable Rate Loans:

Fixed-rate loans offer stability since you know exactly what your monthly payments will be throughout the life of the loan.

This type of loan is best for those who want to budget their finances accurately or have limited income that won’t change significantly during the repayment period.

On the other hand, variable-rate loans come with more risk but may also provide more significant potential savings if interest rates drop during the repayment period. The additional risk may be worth considering if you want to maximize potential savings.

Higher credit scores tend to be rewarded with lower interest rates when taking out a secured loan through Tesco Bank UK or any other lender in Britain.

An arrangement fee, which covers the administration costs incurred by lenders upon setting up new accounts, is typically included in fees associated with secured loans.

Furthermore, property appraisals required by most lenders will incur valuation fees; legal fees related to securing title documents may also apply; and early redemption charges could be charged if borrowers choose to pay off their debt ahead of schedule (this varies between different providers).

Finally, remember to factor in all expenses when estimating the total cost of funding.

Even though a low nominal APR might look attractive initially, once extra charges are added, the overall figure might turn out significantly higher than expected, resulting in an unanticipated financial burden down the line.

Therefore, it pays off to do thorough research beforehand to make informed decisions regarding long-term commitments like these.

It is important to understand the interest rates and fees associated with a Tesco Secured Loan before making any decisions. Realizing the specifics can aid in making an educated choice when considering this type of loan.

Next, let’s look at how to apply for a Tesco Secured Loan.

How to Apply for a Tesco Secured Loan

Applying for a Tesco secured loan is a straightforward process. To be eligible, one must verify they meet the criteria of credit score, income and employment status, and property requirements.

Once these have been met, you can begin the application process by filling out an online form or visiting your local branch.

When applying for a Tesco secured loan, applicants must submit documents such as proof of identity, address, income and existing debts to complete the application process.

These include proof of identity such as a passport or driver’s license; proof of address such as utility bills; evidence of income including bank statements and payslips; details about any existing loans or debts; and information about the property used to secure the loan.

Accuracy is key when filling out the application to prevent any hindrances in processing.

Once all documents and the application form have been submitted, choosing between a fixed or variable interest rate best meets your requirements is essential.

Fixed rates offer peace of mind knowing precisely what payments will be due each month. Variable rates may offer more flexibility depending on market conditions but could result in higher monthly payments if interest rates increase over time.

Finally, additional fees may apply when taking out a Tesco secured loan, so it’s important to read through all terms carefully before signing any agreements.

Make sure that you understand how much money will be borrowed overall, plus any applicable fees associated with early repayment should this become necessary at some point down the line.

With this knowledge, you can confidently sign off on your agreement, knowing exactly what is expected from both parties involved in securing this type of loan product from Tesco Bank UK.

Applying for a Tesco Secured Loan is easy and straightforward, with the necessary documents to apply easily accessible.

Yet, other loan options in the UK may be more suitable for your circumstances than a Tesco Secured Loan; let’s explore some of these below.

Alternatives to Taking Out a Tesco Secured Loan

Other Types of Loans Available in the UK

When considering alternatives to taking out a Tesco secured loan, it is important to know other types of loans available in the UK. These include unsecured personal loans, guarantor loans, and peer-to-peer lending.

- Banks or other financial institutions typically offer unsecured personal loans and do not require collateral such as property or assets.

- Guarantor loans involve having a third-party guarantee repayment if you cannot make payments independently.

- Peer-to-peer lending entails obtaining funds from individual lenders instead of conventional creditors like banks. Borrowers with good credit ratings can take advantage of the more competitive interest rates offered by peer-to-peer lenders, but those without are excluded. This again makes them inaccessible for many individuals looking for alternative forms of finance outside conventional banking systems.

Conclusion

A Tesco secured loan can be a viable choice for those seeking extra funds. However, it is essential to recognize the criteria and costs connected with this kind of borrowing.

Before settling on a Tesco secured loan, it is wise to compare the options available carefully.

Be sure to consider other alternatives, such as unsecured loans or peer-to-peer lending platforms, which may offer better terms than what is available from Tesco Bank.

Take advantage of Tesco’s secured loan options today, with fixed and variable rates available. Quickly check your eligibility to see if you qualify for a bespoke UK lender loan.

Tesco Bank Contact Details:

Registered Office:

Tesco Bank Loan Operations

PO Box 27014, Broadway One, Glasgow

G2 9FE

United Kingdom

Registered Number: SC173199

Financial Services Register number: 186022

https://www.tescobank.com/loans/contact-us/