Are you looking for the best secured loans with bad credit in the UK? Finding reliable and secure lending options can be daunting when your credit score isn’t the greatest.

You may feel like there aren’t many available options, but that is not true! There are plenty of lenders out there who are willing to provide you with competitive rates and terms despite your poor credit rating.

This guide will discuss some of the best secured loan deals for those with bad credit in the UK. We will cover what makes these loans attractive, including competitive interest rates and repayment plans that fit different budgets.

Furthermore, we’ll look at how to apply for such loans and what factors must be considered before deciding. Finally, we’ll explore some pros and cons of taking out such a loan so that readers have all the information they need to make an informed choice about their financial future.

Secured loans can provide invaluable assistance in managing finances during difficult times – especially if one’s credit history is less than perfect.

With careful consideration and research, finding the right deal should be easy – even if you have had trouble accessing other types of financing in the past. So let’s start exploring the best secured loans with bad credit in the UK today.

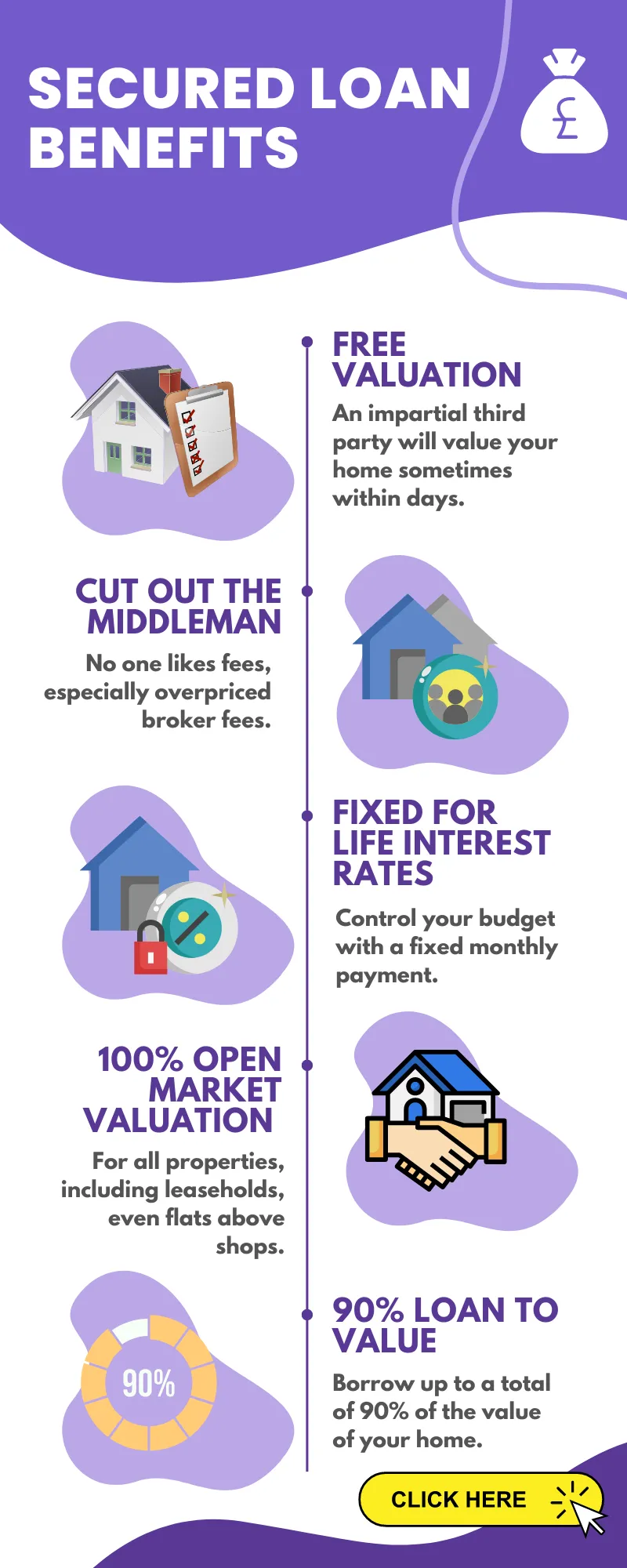

From 1st February 2023, Santander is introducing a new product not available on comparison engine sites

- These offers come with a loan to value of up to 90%, and you don’t need to be an existing Santander customer to take advantage.

- Plus, you’ll get a free, no-obligation third-party property valuation.

- The fixed rate for life is 6.1%, and flats and other leaseholds get full open market valuations.

- You can keep your existing mortgage and match the term for up to 25 years with no arrangement, product or completion fees, or early redemption penalties.

- You’ll get a fast agreement in principle based on a soft credit search without impacting your credit history.

Please complete the initial no-obligation enquiry form:

Understanding Secured Loans

Securing a loan can be tricky, especially if you have bad credit. Knowing the basics of a secured loan and how to obtain one with bad credit is key. Let’s explore the nuances of this type of loan so you can find the best option for your situation.

Starting with the fundamentals, a secured loan requires collateral such as property or other assets used to secure it. This means that if you fail to make payments on time, then there could be consequences related to your asset being taken away from you by the lender.

The process of getting approved for a secured loan is generally easier than an unsecured loan because lenders may view it as less risky since they have something tangible to reclaim should payment not be met.

The requirements for taking out a secured loan vary widely depending on who you’re borrowing from but typically include proof of income, identification documents like your passport or driver’s license, and information about any existing debt obligations.

It’s important to remember that even though having collateral helps improve your chances of approval when applying for a secured loan with bad credit, lenders will still likely assess your financial stability before approving the application.

Overall, securing a loan isn’t impossible even if you have bad credit – it just requires some extra effort and research to find the right lender and terms that work best for you.

With careful consideration given to understanding what exactly is involved with this type of arrangement beforehand, you’ll put yourself in good standing while looking into different options available in the UK specifically tailored towards those with poor credit scores.

Reasons To Consider Secured Loans

Secured loans offer numerous advantages for those with bad credit in the UK. Low-interest rates are a major draw, as they allow borrowers to access funds without becoming trapped in debt. Furthermore, secured loans can rebuild credit and provide financial security over time.

For starters, secured loans often have lower interest rates than unsecured ones. This is because lenders view them as less risky; having collateral attached to a loan means the lender will still receive their money even if the borrower defaults on payments.

Lower interest rates enable borrowers to save money while paying back the loan and make it easier to stay within budget when repaying debts.

The second advantage of taking out a secured loan with bad credit is that it allows people to start repairing their credit score immediately after borrowing money.

As they consistently make timely payments, their credit rating gradually improves until, eventually, they can qualify for more favourable terms from other lenders in the future. Over time, this creates an ever-increasing cycle of financial stability and improved opportunities for those denied access due to poor credit history or lack of assets.

In addition to these benefits, secured loans also give people peace of mind knowing that there is something tangible backing up their loan repayment plan – namely, the asset which was put up as collateral initially.

Knowing that lenders will not simply walk away from your obligations should any problems arise provides much-needed reassurance during times when finances may become tight unexpectedly. All these factors combined make securing a loan with bad credit an attractive proposition for those seeking to rebuild their financial situation quickly and securely.

Credit Ratings And Loan Types

Having bad credit can make it challenging to secure a loan. Fortunately, options are available in the UK for those with low credit ratings.

Individuals must meet specific eligibility requirements to qualify for a secured loan based on their credit rating and debt-to-income ratio. It’s important to understand these criteria before applying so that you know what kind of loan might be best suited to your needs.

There are several different types of secured loans available in the UK. These include home equity loans, vehicle loans, personal loans, and peer-to-peer lending services.

Each type has its own set of requirements when it comes to credit rating requirements and eligibility criteria:

- Home equity loans require applicants to have some form of collateral or security deposit to guarantee repayment, whereas vehicle loans usually rely solely on one’s credit score for approval.

- Personal loans may also be an option if the applicant meets specific income requirements and does not possess any other forms of collateral or security deposits.

- Finally, peer-to-peer lending services provide flexible terms depending on an individual’s circumstances. Still, they typically require higher interest rates than traditional lenders due to the added risk involved with this method of borrowing money.

No matter which route you take, understanding your credit rating is key when considering a secured loan in the UK. Make sure you research beforehand so you know all the details involved before entering into any agreement.

Benefits Of Secured Loans

Secured loans are a great way to access funds, even if your credit rating is not as healthy as you’d like. They allow borrowers with bad credit scores to secure finance and rebuild their financial security.

There are many benefits that come with secured loans, including:

- Improved Credit Rating: Secured loans can help improve your credit score over time by making on-time payments. This will enable you to increase the money you can borrow in future applications and make it easier to get approved for other types of borrowing, such as mortgages or car loans.

- Lower Interest Rates: By providing collateral against the loan, lenders are more likely to offer lower interest rates than unsecured personal loans because less risk is involved. Lower interest rates mean more of each payment goes towards paying off the principal balance rather than accruing interest costs.

- Flexible Payment Options: With secured loans, borrowers have a variety of repayment options available to them, which may include extending the loan length or changing the frequency of payments. This flexibility allows borrowers to tailor their repayments to their budget and lifestyle needs.

By taking out a secured loan, individuals with poor credit ratings can start building up their financial security while having access to additional funds when needed. Potential borrowers must understand that although advantages are associated with secured lending, they should always consider all aspects before applying for any loan.

Uk Financial Institutions Offering Secured Loans

Many UK financial institutions are offering secured loans for people with bad credit. These lenders understand that life doesn’t always go according to plan and offer specialised services tailored to borrowers with low or poor credit ratings.

The following table provides an overview of the top three recommended UK financial institutions for securing a loan:

| Financial Institution | Loan Amounts | Interest Rates |

|---|---|---|

| Bank of Scotland | £2,000 – £25,000 | 3.6% APR |

| NatWest | £1,000 – £25,000 | 4.5% APR |

| Barclays | £1,000 – £20,000 | 7.9% APR |

These financial institutions provide flexible repayment options and will consider all credit ratings when assessing applications.

They also offer quick decisions on loan requests so applicants can receive their funds in as little as 24 hours after approval. Plus, they won’t charge any fees if customers make early repayments on their loans.

For those looking for best secured loans with bad credit in the UK, these financial institutions provide excellent choices and great value-for-money deals.

Whether you need some extra cash or want to consolidate existing debts into one manageable monthly payment, there’s bound to be something here that meets your needs and budget requirements.

Factors Affecting Eligibility For Bad Credit Secured Loans In The Uk

When searching for the best secured loans with bad credit, it is essential to understand the factors that affect eligibility. These include a borrower’s credit score, loan amount and credit history.

A person’s credit score is one of the most important factors lenders consider when assessing loan applications. Generally speaking, borrowers with higher scores are more likely to obtain favourable interest rates on their loans than those with lower scores.

The minimum credit score required will vary from lender to lender, so it is advisable to shop around and compare different offers before applying for a loan.

The amount you want to borrow can also affect your ability to secure a loan with bad credit. Most lenders require a minimum loan amount or limit how much they will lend out depending on applicants’ financial situations.

Some lenders may impose additional requirements, such as having collateral if you want large sums of money. It is, therefore, important to ensure that you meet these criteria before making any commitments.

Finally, your credit history will be considered when determining whether or not you qualify or not.

This includes information about past borrowing behaviour and payments made on time or late, including mortgages, car finance and other personal loans.

Lenders typically use this information to assess your reliability at repaying debt and make decisions accordingly. Consequently, if your history isn’t great, it could influence the terms offered by potential lenders, which could ultimately increase costs over time due to higher interest rates being applied.

Documents Required For Applying For A Bad Credit Secured Loan In The Uk

Applying for a secured loan in the UK with bad credit can be quite challenging. However, it’s not impossible if all your documents are ready and correct.

The following is a list of necessary documents you need to have on hand when filing for a bad credit secured loan:

- Proof of Identity – This includes two forms of identification: a passport or driver’s license.

- Proof of Income & Employment – You will need pay stubs from the last three months and bank statements showing you can make regular payments towards the loan amount.

- Credit Report – It must provide an updated credit report containing information about past loans, current debts, and payment history.

- Collateral – To secure the loan, lenders often require collateral such as property, vehicle title deeds, etc.

Having all these documents at hand before applying for a poor credit secured loan helps streamline the process and increases your chances of getting approved quickly.

Furthermore, it ensures transparency between both parties, i.e., you and the lender, regarding the agreement’s repayment terms and other details. With everything laid out clearly right from day one, there should be no confusion later down the line when making repayments.

Advantages And Disadvantages Of Bad Credit Secured Loans In The Uk

Bad credit secured loans offer a variety of advantages, such as lower interest rates than unsecured loans and longer repayment terms. Additionally, since you’re putting up collateral for this type of loan, it’s easier to be approved than with an unsecured loan. This makes bad credit secured loans a good option if you have poor credit but need access to capital quickly.

However, while they may seem like an attractive solution on the surface, some potential drawbacks are also associated with these types of loans.

For example, if you default on your payments or miss deadlines, the lender can take possession of your collateral – meaning that you could potentially lose whatever asset was used to secure the loan.

Furthermore, because lenders tend to view people with bad credit as higher-risk borrowers, bad credit secured loans often come with more stringent conditions that may not be ideal for all individuals.

It’s essential to carefully weigh the pros and cons before committing to any loan product – especially if it’s specifically designed for those with impaired credit histories.

Secured loans in the UK can help get you out of a financial bind; however, some risk is always involved, so make sure you understand what’s at stake before taking out an adverse credit secured loan.

Comparison Of Different Lenders Offering Bad Credit Secured Loans In The Uk

The increasing demand for bad credit secured loans in the UK has led to a rise in lenders offering them. But how do you compare and decide which is best?

It’s often not straightforward, but understanding what each lender offers can help.

This section will look at some of the top providers, their interest rates and other details that could be important when making your decision.

- First Trust Bank is a popular lender for people with bad credit looking for a loan. They offer competitive rates along with flexible repayment terms.

Their eligibility criteria are stricter, so it’s worth looking into them before applying if you think this might be a suitable option.

- NatWest is another reliable provider, and they provide competitive rates and have less stringent requirements than many other lenders.

As well as these two banks, numerous online-only lenders specialise in providing bad credit secured loans, such as Lending Stream.

Some companies can charge higher interest rates than traditional banks or building societies but may still be an affordable option depending on your financial circumstances and level of risk tolerance.

When comparing different options for a secured loan with bad credit, it’s important to consider more than just the rate each lender offers.

Factors like customer service and flexibility should also play a role in your decision-making process. Researching all available options can ensure that you find the right deal for your needs and secure yourself against potential future problems.

Repayment Options And Interest Rates For Bad Credit Secured Loans In The Uk

When considering a bad credit secured loan in the UK, looking at both repayment options and interest rates is essential. These two factors will determine how much you can pay each month for your loan as well as the overall cost of the loan. Knowing these details can help you select the best option for your circumstances.

Repayment Options: Most lenders offering bad credit secured loans in the UK offer flexible payment plans so borrowers can choose the best option.

Generally, shorter terms mean higher monthly payments but the less total interest paid over time. Longer terms come with lower monthly payments but more total interest paid over time. Many lenders also provide additional options like variable rate or fixed-rate repayment periods depending on their policies and preferences.

Interest Rates: Interest rates vary widely among lenders providing bad credit secured loans in the United Kingdom. To get a better understanding of what’s available, make sure to compare offers from multiple providers before making any decisions.

Typically, borrowers with poor credit scores may be offered higher interest rates than those with good scores; however, this isn’t always the case – shop around for competitive deals even if your score isn’t great!

Some secure lending companies may also offer special discounts or incentives, such as reduced fees, if certain conditions are met.

In short, when selecting a bad credit secured loan in the UK, consider all aspects, including repayment options and interest rates, to find an affordable solution that meets your needs. Thoroughly research various offers from different lenders before signing anything to ensure you get a deal that works for you and your budget.

Alternatives To Bad Credit Secured Loans In The Uk

For those with bad credit, securing a loan can seem daunting. However, there are alternatives to secured loans that people in this situation should consider before making any decisions.

Fortunately, some of these alternative finance options may even prove more beneficial than taking out a traditional secured loan when borrowing money with bad credit.

- One option is to use an online peer-to-peer lender. These lenders offer competitive interest rates and flexible repayment terms for borrowers who don’t qualify for standard bank loans due to their credit history.

The application process for these types of loans is often much quicker and less stringent than traditional banks, making them ideal for those looking for quick access to funds without worrying about being rejected because of their credit score.

- Another alternative borrowing option available is using guarantor loans. This type of loan allows someone with bad credit to obtain a loan by relying on another person (the guarantor) as security against defaulting on repayments.

Although the guarantor will be responsible if you fail to make your payments, they do not need to put up any collateral or have good credit themselves; instead, they need to agree to take over payments if necessary.

- The last alternative finance solution worth considering is a payday loan service provider.

While such services typically come with higher interest rates and shorter repayment periods than other lending forms, they provide an easy way for those with poor credit histories to get short-term access to cash quickly and easily until their next paycheck arrives.

This could allow them time to address issues related to their overall financial health and eventually apply for more traditional long-term financing sources at better rates once their credit has improved.

In summary, while bad credit secured loans might not always be the best choice depending on one’s circumstances, several viable alternatives could work better financially in the long run.

Tips On Finding The Best Deals On Bad Credit Secured Loans In The Uk

With a few simple tips and strategies, you can find a poor credit secured loan that fits your budget and needs.

Here are some tips to help you find the best deal for your needs:

- Check Your Credit Score – Before applying for a secured loan, it’s essential to check your credit score and ensure it is accurate. This will give you an idea of what kind of interest rate you may qualify for.

- Shop Around – Don’t settle for the first offer you get. Compare different lenders and their terms to find the best deal.

- Read The Fine Print – Ensure you understand all the terms and conditions before signing any agreement. Pay special attention to fees, repayment terms, and other details that could affect your loan payments or total cost of borrowing.

- Consider A Co-Signer – If you have a family member or friend with good credit, they may be able to co-sign on your loan, which could help you get better rates and more favourable terms.

With careful consideration, finding a great deal won’t take too much effort or energy at all – keep these tips in mind while shopping around, and you should be able to find something perfect for you soon enough!

Aftercare Support Available When Taking Out A Bad Credit Secured Loan In The Uk

Here are some tips that may help make your search much easier: don’t forget about aftercare support!

- Aftercare Support #1: A reliable and knowledgeable team to assist you before, during and after taking out a loan.

- Aftercare Support #2: Professional service from experienced advisers who can provide sound financial advice when needed.

- Aftercare Support #3: Tailored budgeting plans and payment schedules to ensure manageable monthly payments.

- Aftercare Support #4: Regular communication via phone or email so any questions or concerns can be addressed quickly.

If there’s one thing we know for sure, it’s this – having access to quality aftercare support is essential if you plan to take out a secured loan.

That’s why seeking out a lender who offers comprehensive aftercare services should be at the top of your list. With an experienced team by your side every step of the way, your experience with securing a loan will be more successful and less stressful.

Fees And Charges Associated With Bad Credit Secured Loans In The Uk

Fees and charges associated with bad credit secured loans in the UK can be substantial, so borrowers need to understand what they are getting into before deciding.

In this section, we’ll explore some key fees and charges that may apply when taking out one of these types of loans.

- First, let’s look at origination fees. Lenders typically charge these as part of their processing costs; they may vary between providers but often amount to 1-2% of the loan amount. It’s worth watching this fee, as it can add up over time if you take multiple loans or keep them for long periods.

- Next, there is usually also a late payment charge for any payments received after the due date specified in the contract. Again, something to watch out for if you struggle to repay on time.

- Finally, other potential fees include early repayment penalties (if you pay off your loan too quickly) and default rates (for missed payments).

By understanding all fees and charges associated with bad credit secured loans upfront, borrowers will better appreciate what they’re signing up for – helping them make more informed decisions about their finances.

Frequently Asked Questions

What Is The Minimum Credit Score Required To Apply For A Secured Loan In The Uk?

When applying for a secured loan in the UK, one of the most important factors is your minimum credit score. A good credit score can help you get approved at better rates and terms, while a bad credit score may make accessing certain products or services more difficult.

Knowing the minimum credit score required to apply for a secured loan in the UK is key when considering this option as part of your financial plan.

The minimum credit score needed to obtain a secured loan varies depending on several factors, such as the lender, type of product, and other personal circumstances.

Generally speaking, lenders are less likely to approve applicants with lower scores; however, some lenders offer specialised loans designed specifically for those with poor credit histories. In these cases, an adequate understanding of how secured loans with bad credit work could be beneficial when deciding which product might best suit your needs.

It’s also important to note that even if you have a relatively low score, it doesn’t necessarily mean you won’t be able to access any borrowing power through secured lending options.

Different types of collateral can sometimes compensate for any deficiencies in your overall profile and increase approval chances even if your rating isn’t great. Understanding all aspects of obtaining a secure loan in the UK will give you greater insight into whether this financial solution is right.

Are There Any Associated Risks When Taking Out A Bad Credit Secured Loan?

When considering any loan, particularly a secured one, knowing the risks involved is essential before signing on the dotted line.

With bad credit secured loans, although they may provide much-needed funds at reasonable interest rates, borrowers should consider that lenders might use their assets or property as collateral in case of non-payment. This means that if payments cannot be met, your security will become theirs, which could leave you worse off than where you started.

For those looking to apply for an adverse credit secured loan, understanding these risks is key; however, there are steps you can take to help protect against them.

- Firstly, make sure all terms and conditions are understood fully before agreeing to anything – this includes making sure payment dates and amounts are clearly outlined so that no surprises arise further down the line.

- Secondly, check your current financial situation beforehand, so you know exactly how much money is available each month for repayment – ensuring payments won’t need to be missed or defaulted upon due to an unexpected lack of income or other costs arising throughout the course of the agreement period.

In short: bad credit secured loans offer access to funding. Still, they must not be taken lightly as associated risks could have implications for both borrower and lender alike if not managed appropriately.

Before deciding whether such a loan is right for you, researching thoroughly and weighing up all options first is advisable to ensure any application is made confidently and without unpleasant surprises later.

How Long Does It Take To Process A Bad Credit Secured Loan Application?

Are you looking to take out a bad credit secured loan but unsure how long it will take to process your application? Understanding the duration of an application processing time can help inform decisions regarding taking on a loan.

It’s important for consumers to be aware that applying for a loan with poor credit comes with certain risks, so understanding the timeline involved is essential.

When considering a bad credit secured loan, applicants must understand the average duration from submitting their applications until approval or denial.

Generally speaking, most lenders have different procedures and protocols, which may affect the time needed for each case. However, some common factors, such as employment status and income verification, could influence the timeframe required for review and decision-making by financial institutions.

In addition, banks and other lending companies typically require additional documentation, such as proof of residence or bank statements, before approving any type of loan request; this might also add extra days or weeks, depending on how quickly the borrower can provide these documents.

The best way to estimate an accurate application processing time is to contact potential lenders directly and inquire about their specific policies and processes associated with bad credit loans.

No matter what type of loan you seek – short-term or long-term – knowing exactly how long it takes for your particular situation is paramount information that should not be overlooked. With this knowledge, borrowers can make informed risk management decisions while remaining confident throughout the process.

What Is The Maximum Loan Amount I Can Get With Bad Credit?

The maximum loan amount depends on several factors. If you have a poor credit score and want to take out a secured loan, understanding how much money you can borrow is key. Knowing this information ahead of time can help you make more informed decisions about your finances.

Secured loans require collateral such as property or assets that will be used as security if the borrower fails to keep up with their repayments.

Depending on the lender’s requirements, the type of asset they accept as collateral may be limited. Your past credit history may also impact the maximum loan amount available to you, so it’s essential to understand your current financial situation before taking out a loan.

In addition, different lenders offer varying rates and terms, which could affect your ability to secure a higher loan amount. It’s wise to shop around and compare the options from multiple lenders when seeking bad credit secured loans in the UK; doing so ensures you get the best deal possible.

Consider both APR (Annual Percentage Rate) and any other fees associated with each lender before making a decision – this helps ensure that you don’t end up paying more than necessary over the term of your loan agreement.

By researching all aspects of securing a bad credit loan in advance, borrowers can maximize their chances of finding an option that works for them and provides access to funds even with poor credit scores.

This allows for greater peace of mind knowing that support is available should unexpected expenses arise at any stage during repayment periods or after repaying outstanding debts successfully.

Are There Any Other Loan Options Available For People With Bad Credit?

Are there any other loan options available for people with bad credit? This is a question that many individuals and families in the UK are asking.

As more lenders tighten their eligibility requirements, finding loans for those with poor credit scores is becoming increasingly difficult. Fortunately, several types of loans can still be used by those with bad credit.

Bad credit mortgages, unsecured loans, and debt consolidation loans are all viable options for people with a low credit rating:

- Bad Credit Mortgages – These allow borrowers to purchase property even if they don’t qualify for traditional mortgage products due to their credit history.

- Bad Credit Unsecured Loans – With these types of loans, borrowers don’t need to pledge collateral as security against the loan; instead, only an agreement must be made between the borrower and the lender.

- Debt Consolidation Loans – A debt consolidation loan allows individuals to combine multiple debts into one monthly payment to manage their finances more efficiently.

When looking for best secured loans with bad credit in the UK, it’s essential to understand which type of loan works best for your financial situation and lifestyle.

For instance, while bad credit mortgages may offer lower interest rates than other forms of financing, they typically require larger down payments. They involve higher closing costs — making them better suited for those with some savings or cash reserves.

On the other hand, getting an unsecured loan may provide quick access to funds without requiring collateral but could come with very high-interest rates depending on your individual circumstances.

Lastly, debt consolidation loans are ideal solutions for those struggling with heavy debt because they allow them to pay off existing balances over time without worrying about extra fees or compounding interest charges from multiple creditors.

It pays to do research before taking out any loan; understanding how each option works will help you make informed decisions about what is suitable for you financially in the long run.

Comparing different lenders’ terms and conditions and online reviews can also give you insight into what experiences others may have had when applying for similar products – giving you greater confidence moving forward when deciding which route is right for you.

Conclusion

Finding the best secured loan with bad credit in the UK is often tricky. Searching for and obtaining a loan can be daunting, especially when your credit score isn’t ideal. However, there are options available that may help you secure the funds you need.

With some research and an understanding of associated risks, finding an affordable and reliable loan solution is possible.

Symbolically speaking, borrowing money can sometimes feel like climbing a mountain: it takes time and effort, but once at the top, the view is worth all of it.

When taking out a bad credit secured loan, remember to take caution as any misstep could lead to further debt or defaulting on payments.

That being said, if done right, this type of loan could provide much-needed financial security during times of crisis.

While getting approved for a secured loan with bad credit might seem impossible at first glance, careful consideration and research can open up more opportunities than expected.

My advice would be to understand your current situation and make sure whatever option you choose will benefit you in the long run. Good luck!